CATEGORIES

-

Annual Promotions: Recognizing Excellence Across the Firm

ATLAS CPAs & Advisors, with CMMS CPAs & Advisors, an ATLAS Navigators, LLC firm, announces 2026 team member promotions across all locations. ATLAS CPAs & Advisors, an ATLAS Navigators, LLC firm, is excited to announce the promotion of several team members throughout its 25 locations; five of which are based in Texas, operating as […]

February 16, 2026 READMORE -

HIRING A FRACTIONAL EXECUTIVE

It’s a new year! 1st Quarter is an ideal time to evaluate your business operations and consider whether support from new leadership could benefit your organization. Traditionally, companies value long executive tenures, often expecting leaders to stay five years or more to provide stability and develop a deep knowledge of company culture and operations. While […]

January 27, 2026 READMORE -

Calendar of Important Dates in 2026

The new year has begun, and tax season is in full swing! There are important dates and deadlines to consider ensuring timely tax filing and payments throughout the year, while also planning for government holidays that may cause deadline adjustments. If you have any questions, please do not hesitate to reach out to your ATLAS […]

January 6, 2026 READMORE -

How Donations Can Boost Deductions on Taxable Income

Donations increase substantially in November and December, with nearly 45% of annual donations made during this time (Harness, n.d.). Two main reasons for this are: Holidays inspire non-profits to launch donation campaigns. People feel more generous during the holiday season. Another reason people often forget about is to gain tax benefits. Making donations can reduce […]

December 4, 2025 READMORE -

AI REGULATION IN COLORADO: WHAT AI DEVELOPERS NEED TO KNOW

Artificial Intelligence (AI ) is a great tool for business and individual use. It can help you find information online quickly, often with different and more digestible results than your average search engine provides. And with technology continuously advancing, AI usage has surged in recent years, nearly tripling since 2020. Forbes reported, “378 million people […]

November 1, 2025 READMORE -

Retirement’s Haunted House: IRMAA, the Monster Behind the Door

Retirement is often imagined as a peaceful life transition. Activities like traveling, trying out hobbies, and spending time with loved ones replace traditional workflows. But for many retirees, their finances can feel like a new and scary workflow – like wandering through a haunted house. Each door (decision) might reveal a surprise effect. One of […]

October 27, 2025 READMORE -

Managing Remote Staff from ATLAS Certified Payroll

Remoter workers (full-time) make up about 14% of the US workforce. That’s lower than in 2020, when the COVID-19 pandemic made remote work necessary for many. But even though fewer people work remotely now, remote job opportunities are still growing (McDermott, 2025). Because of this, it’s important for managers and company leaders (even those who […]

September 17, 2025 READMORE -

OHIO UNCLAIMED FUNDS: WHAT YOUR BUSINESS NEEDS TO KNOW

All businesses and banks operating in Ohio are required to complete and submit a National Association of Unclaimed Property Administrators (NAUPA) report to the Ohio Department of Commerce Division of Unclaimed Funds by November 1st, 2025. What does this mean for your business, and how can your ATLAS advisors help? Read below for key details […]

September 1, 2025 READMORE -

ATLAS NAMED A 2025 TOP 50 CAS PRACTICE BY WOODARD

It is our great privilege to announce that ATLAS Navigators, LLC has received the Woodard Top 50 CAS Practice Award for 2025! This esteemed honor recognizes firms which not only meet the industry standard definition of Client Accounting Services (CAS), but also make Advisory Services a core aspect of business, going above and beyond to […]

August 1, 2025 READMORE -

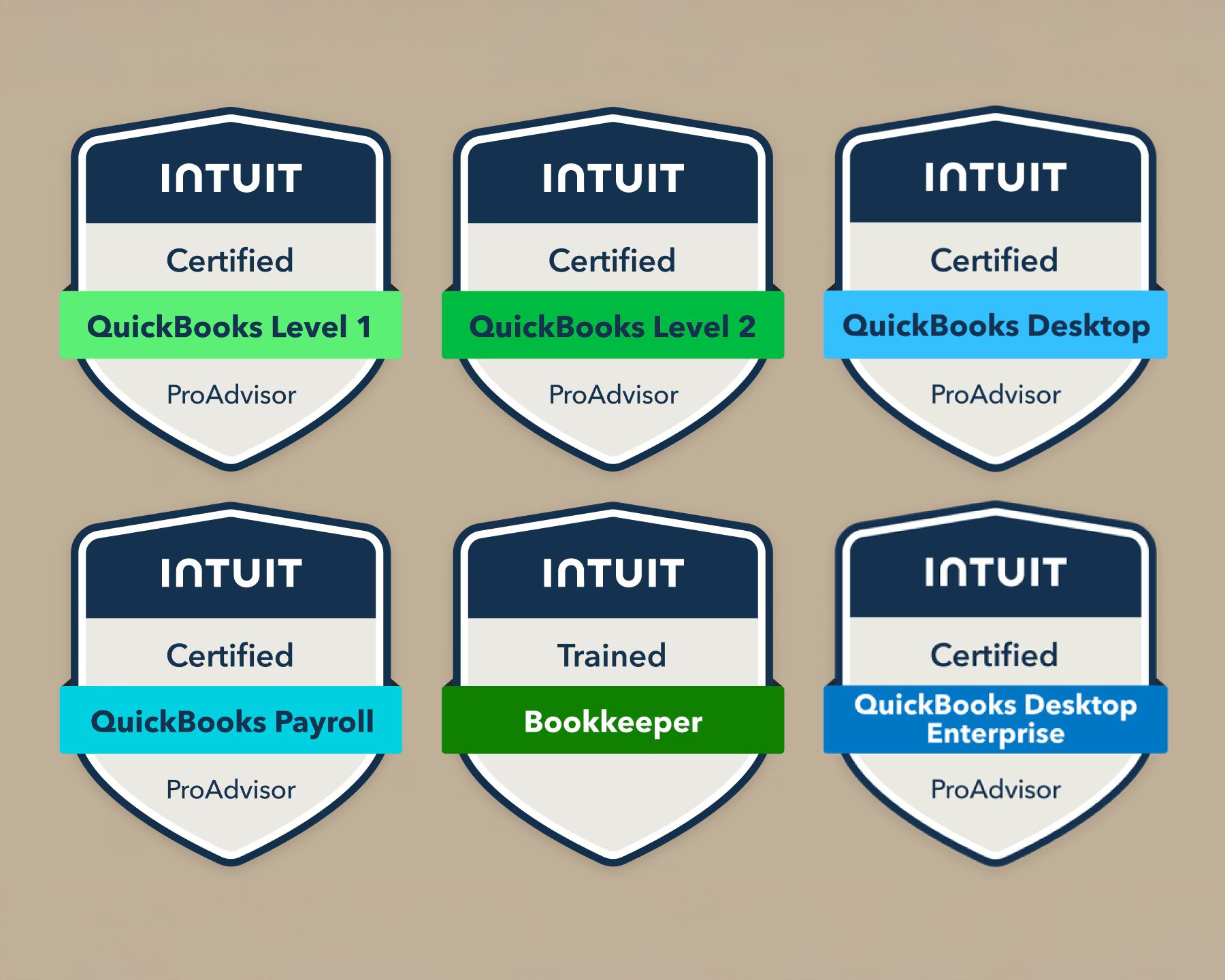

CERTIFIED QUICKBOOKS STAFF: ATLAS CELEBRATES 2025

Every year, QuickBooks Online ProAdvisors must complete an exam to update their certifications and renew access to ProAdvisor benefits. QuickBooks provides training materials to help certified users learn about new features and updates before taking the exam. The recertification window typically spans two months — May and June — during which users must complete and […]

July 10, 2025 READMORE -

HOW MIGHT YOUR TAX RETURNS BE IMPACTED BY SUMMER PLANS?

Summer is a great time to unwind and enjoy the warm weather. But we all know that finances do not go on ‘summer break’! If anything, your finances may be over extended during the summer between paying for kids camps and daycares, home remodeling projects, family trips, and more. As you plan for those [often […]

June 16, 2025 READMORE -

IRS Phases Out Paper Checks for Tax Refunds

Executive Order 14247 (See Sec. 3) requires the U.S. Department of the Treasury, in coordination with the Internal Revenue Service or IRS (and other federal agencies), to phase out paper tax refund checks for individual taxpayers, starting on September 30th, 2025. If you have ever received payment from the IRS or paid them using paper […]

June 9, 2025 READMORE -

DO YOU KNOW ABOUT THE IRS ‘DIRTY DOZEN’?

Ever heard of the IRS “Dirty Dozen”? If you don’t know about this list, you should! Scams of all types – phishing, identity theft, cyber security threats, and the like – are becoming more advanced and prevalent every day. To help U.S. citizens stay vigilant in the safety of their personal information – both online, […]

May 22, 2025 READMORE -

CELEBRATING “OLDER AMERICANS MONTH” – AGING WELL & STAYING CONNECTED

A special thanks to our Financial Planning & Investment Partner, Michael Abbate, head of our Lifestyle Planning Group, for his contributions to this article. May marks Older Americans Month, a time to honor the incredible contributions, wisdom, and resilience of our ‘elders.’ This year’s theme, Powered by Connection, highlights how relationships foster independence and well-being […]

May 14, 2025 READMORE -

FINANCIAL LITERACY MONTH: STOCKS & BONDS

For many, finances are an ‘off-limits’ conversation, and yet, we need to make big, important financial decisions at various times in our lives. Even those small financial decisions can have a big impact if not handled thoughtfully. But if financial literacy is not a national requirement in our school systems, and our parents may (or […]

April 25, 2025 READMORE -

420: INTERVIEW WITH CEO OF MAZOR COLLECTIVE CANNABIS

The cannabis industry is growing faster than you think, with an estimated market size of $38.5 Billion in 2024, and a projected annual growth rate of 11.5%, according to a report from Grand View Research. This year, for ‘4/20,’ we connected with impressive, woman entrepreneur, Lilach Mazor Power – founder and CEO of Mazor Collective, […]

April 17, 2025 READMORE -

What to Do if You Can’t Meet The 2025 Tax Filing Deadline

Are you worried about not filing your taxes by the April 15 deadline this year? What you need is a way to gain more time to file – without incurring penalties. Dan Burrus, the ATLAS Tax Manager for our Cedar Rapids, Iowa, and Marion, Illinois offices, recommends requesting a filing extension. Burrus spoke with WSILTV […]

April 14, 2025 READMORE -

Get To Know The ATLAS Internship Program

As an accounting firm, we understand the importance of continual education. Promoting education in the tax industry and the wider business world motivates us to evaluate and enhance the services we provide to our clients. One way we incorporate education at ATLAS is by leading an internship program each year during tax season. Some tax […]

April 11, 2025 READMORE -

Identity Theft: Essential Tips to Protect Your Data

What would you do if you discovered identity theft? Do you know what is on your credit report? Think about how often you receive a letter reporting a data breach. The Identity Theft Resource Center (ITRC) reports that the U.S. experiences a couple thousand data breaches every year (Chin, 2024.) A couple thousand! Even if […]

April 7, 2025 READMORE -

Find the Frog: Improving Workplace Culture & Productivity

As business owners, we all want to create the best possible working environment for our staff; fostering community, while promoting a high level of production. And as employees, we all want to be part of that working environment. One that is fun, but not so fun that nothing gets done. Friendly, while not resulting in […]

March 24, 2025 READMORE -

Business Ethics & The Implications of AI

While ethics in business may seem black and white, in actuality, business ethics are always adapting to keep up with changes in society, technology, and industry-specific matters. With Artificial Intelligence (AI) rapidly integrating into business operations and our daily lives, it is more important than ever to consider the ethical impact of AI. ATLAS Partner, Michael […]

March 18, 2025 READMORE -

Strengthen Your Business Security Mindset

Is your business and client information fully secure? If not, read below for ATLAS insight on how to secure your business from cyber criminals. Small to medium sized businesses may not operate using the same departments that large companies have, such as research, IT, and business strategy. And yet, security measures for small to medium […]

March 6, 2025 READMORE -

Expect the Unexpected: What to Do if You are Laid Off

Job layoffs are instances most workers are not prepared for. It’s important to understand what comes next, so you can manage financial changes. Sometimes layoffs are company-wide, which can displace whole departments and negatively affect the broader community. Sometimes the only job cut is your own, and it can be easy to feel lost without […]

February 26, 2025 READMORE -

Gigs & Side-Hustles: What you need to know

You may have heard the terms, “gig economy” or “side hustle” before – terms that have been around for a long time, but concepts that are worth revisiting. While these terms technically refer to different things, they are not mutually exclusive, and are often interchangeable. But, why are these types of jobs so important to […]

February 18, 2025 READMORE -

Romantically Taxed: How Taxes Change When You Get Married

Are you married and have a Valentine? If so, you might want to think with your heart and wallet. With tax season in full swing, ATLAS CPAs & Advisors wants to provide you with the best information to evaluate whether you and your spouse should file separate or joint. There are benefits and drawbacks for […]

February 14, 2025 READMORE -

Tax Relief for those affected by California Wildfires

The ongoing destruction from wildfires and high winds in southern California is severe. We, at ATLAS, are very sorry to hear of the numerous homes, businesses, and lives lost in this disaster. We are here to help and support our clients as best we can, by providing updates that my affect you. If you know […]

January 13, 2025 READMORE -

2025 Calendar of Important Dates

As we settle into the new year, ATLAS offers this annual, friendly reminder of important dates and deadlines to keep in mind in 2025. We encourage clients to take note of these various due dates to ensure timely filing and payments throughout the year, while also planning for government holidays that may cause deadline adjustments. […]

January 8, 2025 READMORE -

ATLAS Announces Annual Team Promotions

ATLAS CPAs & Advisors, with CMMS CPAs & Advisors, an ATLAS Navigators LLC firm, announces 2025 team member promotions across all locations. ATLAS CPAs & Advisors, an ATLAS Navigators LLC firm, is excited to announce the promotion of several team members throughout its 26 locations; five of which are based in Texas, operating as CMMS […]

January 3, 2025 READMORE -

News: BOI Temporarily Halted by Preliminary Injunction

* Post Updated * The Department of Justice has filed an application with the U.S. Supreme Court asking that it lift the injunction on BOI reporting requirements. Friday, January 3, 2025, the Supreme Court set a deadline of 4:00 PM Eastern, January 10, 2025, for the plaintiffs in this case to respond to the request […]

December 4, 2024 READMORE -

TCJA IS ENDING: PREPARE FOR THE CHANGES

The Tax Cuts & Jobs Act (“TCJA”) was passed & signed into law on December 31, 2017. Many key provisions of the TCJA are expected to expire on December 31, 2025. Tax planning is important to ensure your wealth stays in the family. The goal of the Tax Cuts & Jobs Act (TCJA) was to […]

November 1, 2024 READMORE -

ATLAS Mid-Year Team Promotions

ATLAS CPAs & Advisors, with CMMS CPAs & Advisors, announces its 2024 mid-year team member promotions across all locations. ATLAS CPAs & Advisors PLLC, with CMMS CPAs & Advisors PLLC in West Texas, are excited to announce the promotion of several team members throughout the 26 locations operating under ATLAS Navigators LLC. ATLAS is an […]

October 4, 2024 READMORE -

BITE INTO SAVINGS: TAX DEDUCTIONS FOR BUSINESS MEALS

A good business plan includes a solid tax strategy. This article is your reminder to pay attention, not only to revenue and growth, but also tax deduction opportunities in parallel to profit. Deductions can be an important aspect of tax strategy, as – when recorded properly – can produce some valuable tax savings. ATLAS knows how […]

September 9, 2024 READMORE -

Tax Cuts & Jobs Act Expires in 2025

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, introduced significant tax changes which are set to expire at the end of the year in 2025. The expiration of the TCJA’s individual tax benefits — including reduced tax rates and higher standard deductions — will likely lead to increased tax liabilities for many […]

August 30, 2024 READMORE -

Social Security Changes Online Login

A recent press release from the Social Security Administration (SSA) announces a transition to the use of Login.Gov for all SSA online accounts and services. SSA account holders who already have a Login.Gov or ID.Me account do not need to take any action. Rather, this announcement is particularly critical for those whom created their SSA […]

July 18, 2024 READMORE -

COLORADO TEMPORARILY REDUCES TAX RATE

The state of Colorado has enacted legislation to temporarily reduce the state income tax rate for these applicable taxpayers: individuals, estates, trusts, and corporations – regardless of whether a corporation is foreign or domestic. The tax rate will be reduced from 4.40% to 4.25% for the 2024 tax year. What About Future Years? Regarding the […]

June 17, 2024 READMORE -

Is Your CPA Part Of Your Summer Routine?

Do your summer plans include a meeting with your CPA? If they don’t, maybe they should! Summer is upon us! We love the hot weather, bright sunshine, and cool days in the pool. And while everyone else is busy planning their beach time or camping trips — you could be busy planning your tax strategy […]

May 21, 2024 READMORE -

Roth IRAs for Kids

Small businesses play a significant role in labor markets. They employ 61.7 million Americans; 46.4 percent of all private-sector employees. In the past 29 years, small businesses have been responsible for generating 17.3 million net new jobs, which accounts for an impressive 62.7 percent of all jobs created since 1995. (1) Knowing the impact small […]

April 23, 2024 READMORE -

Social Security: Financial Literacy Month

Social Security is a cornerstone of retirement income for millions of Americans. Social Security intertwines with personal financial decisions in complex ways as we plan for-, get close to-, and live in- our retirement. In light of the role Social Security plays in retirement funding, it is important to have a solid grasp on financial […]

April 3, 2024 READMORE -

The Importance of Sound Financial Planning

Do you feel ready for retirement? If your answer is “no,” you are not alone. A report released in 2023 from the Federal Reserve System shows that only 31% of adults feel they are financially ready for retirement. (1) Being negligent of your retirement planning could cast a long shadow over your golden years. The […]

March 21, 2024 READMORE -

Retirement Strategies for Women – Women’s History Month

Preparing for retirement can look a little different for women than it does for men. Although stereotypes are changing, women are still more likely to serve as caretakers, meaning they may accumulate less income and benefits during their lifetime, due to time away from the workforce. One study estimates that 66% of caregivers are women. […]

March 18, 2024 READMORE -

Have you Selected your Retirement Plan Beneficiaries?

Do you have a retirement plan? Most individuals will probably answer, “yes.” They may even answer, “yes,” multiple times, having more than one established retirement account. (1) Yet, while retirement plans are commonplace, many plan participants have a hard time answering the question: Who have you selected as your retirement plan beneficiary? Your account beneficiary […]

March 13, 2024 READMORE -

Get Financially Fit – Exercise your Financial Muscles

What is financial fitness? We are all familiar with the term “physical fitness,” and if pressed for a definition, could come up with an explanation related to levels of strength, a routine of physical activity, and the effects on overall health. But each individual will explain this a little differently based on their personal history, […]

March 7, 2024 READMORE -

Financial Strategies for Women – Women’s History Month

This month, we are focusing on the financial planning aspect of ATLAS with our Lifestyle Planning Group (ATLAS LPG.) As March is also Women’s History Month, we take this opportunity to highlight some important information for- and about- women in the financial planning realm. More and more women are providing for their families, however there […]

March 1, 2024 READMORE -

Roman Numerals – Fun facts for Super Bowl

Super Bowl LVIII is coming up! But if the news and internet had not told you this was Super Bowl “58” …would you know what LVIII meant? Roman numerals are a bit antiquated, yet the NFL adheres firmly to this naming convention when it comes to the Super Bowl. Though everything can be figured out […]

February 9, 2024 READMORE -

Planning for your Financial Future

Have you thought about the financial, business, or life priorities that you want (or need) to address this year? 2024 is still new, and now is an excellent time to think about the investing, saving, or budgeting methods you could employ toward specific objectives – whether that is building your retirement fund, considering an estate […]

January 29, 2024 READMORE -

New ATLAS Locations in Northern California

Local CPA Firm, Crippen & Associates, Announces Merger with ATLAS CPAs & Advisors, An ATLAS Navigators, LLC Firm Full-service accounting firm, Crippen & Associates, with two locations based in Marysville and Colusa, California has recently announced their merger with ATLAS CPAs & Advisors PC, an ATLAS Navigators, LLC Firm (ATLAS.) ATLAS is a tax, accounting, […]

January 15, 2024 READMORE -

IRA Contribution Deadlines Reminder

Many of us associate taxes with spring because the annual tax filing due date is mid-April. However, making annual contributions to your Individual Retirement Account (IRA) are an important aspect of your taxes. As we think about IRA contributions heading into 2024, there are a few distinctions worth noting. * Remember, this article is for […]

January 12, 2024 READMORE -

Colorado Announces 2023 TABOR Refund Details

Toward the end of 2023, the Colorado Department of Revenue confirmed the TABOR refund amounts payable to taxpayers in 2024, and the stipulations for claiming said refund. Continue reading for more information. “Each qualified taxpayer will receive an identical sales tax refund of $800,” according to a Colorado Department of Revenue memo prepared by the […]

January 9, 2024 READMORE -

IRS Announces ERC Voluntary Disclosure Program

As a follow up to our previous post regarding ERC, we want to share details of the new ERC Voluntary Disclosure Program, recently announced by the IRS. ERC REMINDER As a friendly, the ERC – Employee Retention Credit – is a complex tax credit for businesses and tax-exempt organizations which retained their employees through COVID-19. […]

January 5, 2024 READMORE -

ATLAS Announces Annual Team Promotions

ATLAS CPAs & Advisors, with CMMS CPAs & Advisors, announces 2024 team member promotions across all locations. ATLAS CPAs & Advisors PLLC, an ATLAS Navigators, LLC Firm, is excited to announce the promotion of several team members throughout the 25 ATLAS locations. Five of ATLAS’s locations are based in Texas, operating as CMMS CPAs & […]

January 3, 2024 READMORE -

ATLAS Announces Promotion of Andrew Wendt to Partner

Andrew Wendt joined ATLAS CPAs & Advisors at the Partner level on January 1st, 2024. He brings more than 13 years of experience to ATLAS, including time spent performing audits in public accounting, as well as internal audits. Andrew has spent the past 3 years as a Senior Audit Manager in ATLAS’s Northwest Phoenix and […]

January 2, 2024 READMORE -

2024 Calendar of Important Dates

As we head into the new year, ATLAS offers this annual, friendly reminder of important dates. We encourage clients to take note of these various due dates, to ensure timely filing and payments throughout 2024. If you have any questions, please do not hesitate to reach out to your ATLAS or CMMS office directly; or […]

December 29, 2023 READMORE -

Year End Roth Conversions

ATLAS Lifestyle Planning Group (ATLAS LPG) brings you an informational mini-series, focused on a few key areas of financial planning that could help you wrap up the year feeling better prepared. PART 3: ROTH CONVERSIONS Don’t forget to have a discussion with your tax professional about Roth IRA conversions before the end of the year. […]

November 30, 2023 READMORE -

Year End Tax-Loss Harvesting

ATLAS Lifestyle Planning Group (ATLAS LPG) brings you an informational mini-series, focused on a few key areas of financial planning that could help you wrap up the year with a feeling of understanding and a little more control. PART 2: TAX-LOSS HARVESTING What is Tax-Loss Harvesting? Great question! First of all – to be clear […]

November 22, 2023 READMORE -

Year End Planning for Older Individuals

Year-end planning is one of the best things you can do for yourself to prepare for the coming year, and any challenges you may face. But there is so much to consider, how do you know where to begin? Planning can easily become overwhelming, and ultimately skipped because of it. ATLAS Lifestyle Planning Group (ATLAS […]

November 18, 2023 READMORE -

IRS Freezes ERC Processing & Cautions Taxpayers of ERC Scams

Everyone knows COVID-19 did a number on the economy. And though we are now over 3 years away from the start of the pandemic, we are still working through the changes that came as a result of that point in history. One such matter is the ERC – the Employee Retention Credit; or sometimes called […]

November 3, 2023 READMORE -

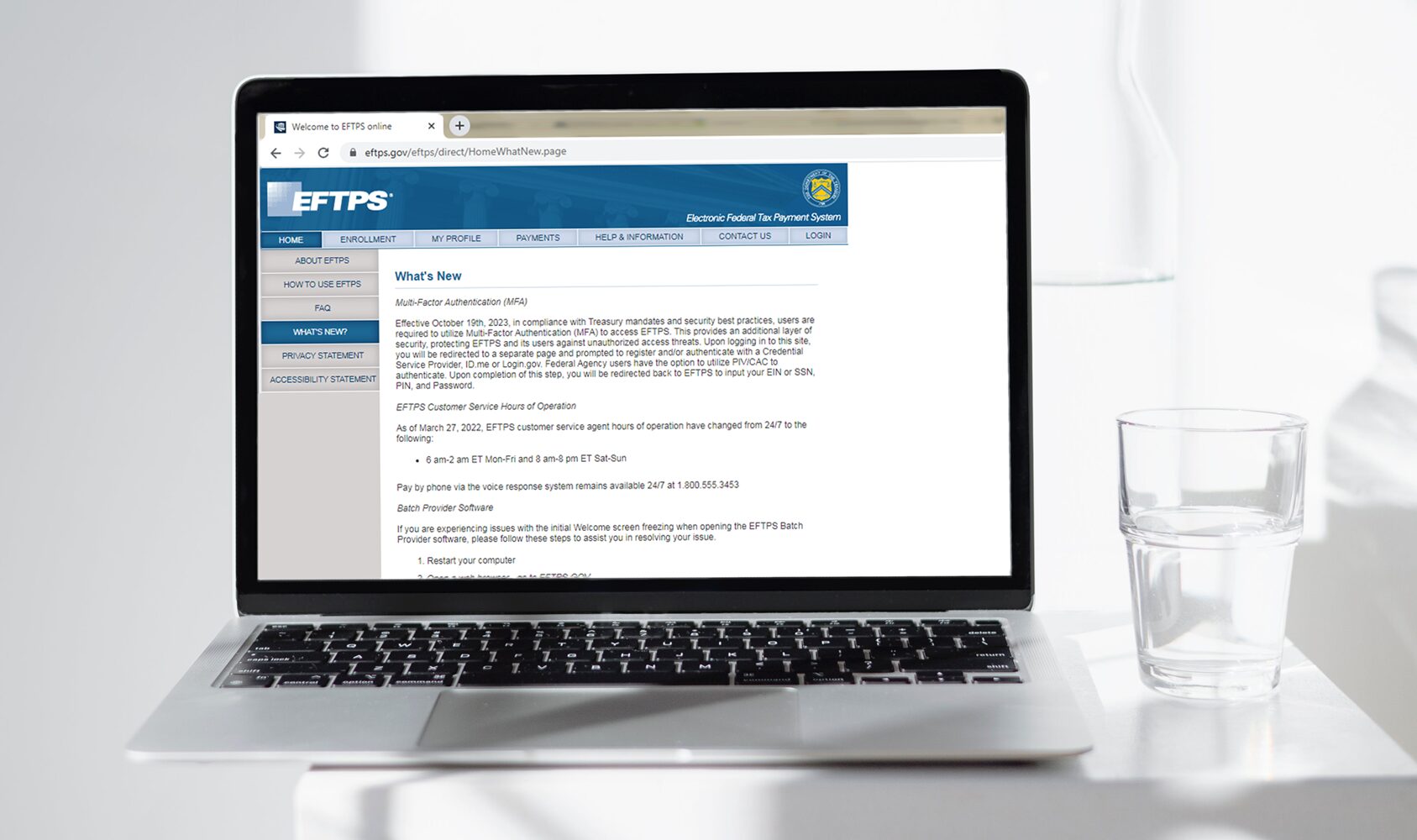

EFTPS Now Requires MFA

The Electronic Federal Tax Payment System – more simply referred to as EFTPS – recently announced their implementation of multi-factor authentication for all EFTPS payments. For those who do not know, EFTPS is a secure, free service from the U.S. Department of Treasury through which federal taxes can be paid. Certain federal taxes, such as […]

November 1, 2023 READMORE -

PLANNING YOUR FINANCES: WHAT AN ADVISOR CAN DO FOR YOU

For some, financial planning feels like one of those “optional” adult responsibilities. For others, financial planning is perceived as only being necessary if you are “wealthy,” close to retirement, or are someone who already has an in-depth knowledge of finances. In reality, it’s one of the most valuable investments you can make for your future. A […]

September 21, 2023 READMORE -

Client Axcess Portal Instructions

Dear Clients: In July 2022, ATLAS began a major software conversion. This transition brought all teams onto the same system, streamlining the way we work with our clients, and each other; as well as enhancing the system to provide clients with a higher level of service, due to the capabilities of the programs being used. […]

June 9, 2023 READMORE -

ATLAS Announces Promotion of Elaine Pressler, CPA/ABV, to Partner

Elaine K. Pressler, CPA/ABV, joined ATLAS as a Partner in our Akron and Canton, Ohio offices in January 2023. She has more than 30 years of experience in the practice of Public Accounting, with areas of expertise in small business advisory services, business and individual tax return preparation, business valuations, firm management, and more. “I […]

January 2, 2023 READMORE -

ATLAS Expands Colorado Springs Location

We are excited to announce the addition of two new ATLAS locations in Woodland Park and La Jara, Colorado. With this merger, a third office, originating in the North Colorado Springs area, will be moving downtown to join our established Colorado Springs office at 455 E Pikes Peak. Expanding ATLAS’s reach in the Colorado Springs […]

November 17, 2022 READMORE -

ATLAS Billing Policy

The ATLAS billing policy is designed to be efficient, consistent and transparent for clients. Once the client’s work is completed, ATLAS creates an invoice for the time put into that work, or per an arrangement on an engagement letter. If the work ATLAS does for a client involves a lengthier process or ATLAS is waiting […]

June 1, 2022 READMORE -

2021 Tax Planning Letter – Businesses

Dear Business Client: With year-end approaching, it is time to start thinking about moves that may help lower your business’s taxes for this year and next. This year’s planning is more challenging than usual due to the uncertainty surrounding pending legislation that could increase corporate tax rates plus the top rates on both business owners’ […]

December 7, 2021 READMORE -

2021 Tax Planning Letter – Individuals

Dear Clients, With year-end approaching, it is time to start thinking about moves that may help lower your tax bill for this year and next. This year’s planning is more challenging than usual due to the uncertainty surrounding pending legislation that could, among other things, increase top rates on both ordinary income and capital gain […]

December 7, 2021 READMORE -

Year-End Tax Planning 2021 Document

Click the link below for a document focused on what you need to know for Year-End Tax Planning for 2021. This includes information for both individuals and business. Please don’t hesitate to contact us with questions or if more information is needed! Click title below to open: Year-End Tax Planning Document 2021-ATLAS

November 17, 2021 READMORE -

New ATLAS Location – Tucson, AZ

We are excited to announce our newest ATLAS location in Tucson, Arizona! This is an exciting expansion for the ATLAS family of firms, broadening our reach in the southwest. Continue reading about this recent merger in our press announcement below. Metzger, Klawon & Fox PLC Announces Merger with ATLAS CPAs & Advisors PLLC an […]

September 15, 2021 READMORE -

American Rescue Plan Act of 2021 – Businesses

The American Rescue Plan Act of 2021 (ARPA), signed by President Biden on March 11, 2021, is the latest major legislation that provides economic relief and stimulus, both tax and non-tax, during the Covid-19 pandemic. Below are brief summaries of the key aspects of the tax provisions in ARPA. Provisions Affecting Businesses Payroll tax credits. […]

April 26, 2021 READMORE -

American Rescue Plan Act 2021 – Individuals

The American Rescue Plan Act of 2021 (ARPA), signed by President Biden on March 11, 2021, is the latest major legislation that provides economic relief and stimulus, both tax and non-tax, during the Covid-19 pandemic. Below are brief summaries of the key aspects of the tax provisions in ARPA. Provisions Affecting Individuals Recovery rebate credits […]

April 26, 2021 READMORE -

Making Sense of Your Statement of Cash Flows

The statement of cash flows essentially tells you about cash entering and leaving a business. It’s arguably the most misunderstood and under-appreciated part of a company’s annual report. After all, a business that reports positive net income on its income statements sometimes doesn’t have enough cash in the bank to pay its bills. Reviewing the […]

April 26, 2021 READMORE -

The American Rescue Plan Act has passed: What’s in it for you?

Congress has passed the latest legislation aimed at providing economic and other relief from the COVID-19 pandemic that has haunted the country for the last year. President Biden is expected to sign the 628-page American Rescue Plan Act (ARPA), which includes $1.9 trillion in funding for individuals, businesses, and state and local governments. The ARPA […]

April 26, 2021 READMORE -

2021 Tax Calendar

To help you make sure you don’t miss any important 2021 deadlines, we’ve provided this summary of when various tax-related forms, payments and other actions are due. Please review the calendar and let us know if you have any questions about the deadlines or would like assistance in meeting them. We encourage you to mark […]

April 26, 2021 READMORE -

New ATLAS Location – Longmont, CO

We are excited to announce a new ATLAS location has been added along the front range of Colorado. The addition of our Longmont, CO office is an exciting expansion for the ATLAS family of firms. Continue reading about this recent merger in our press release below. Clausen & Associates, P.C. announces merger with ATLAS […]

February 1, 2021 READMORE -

Getting More for Your Marketing Dollars in 2021

A new year has arrived and, with it, a fresh 12 months of opportunities to communicate with customers and prospects. Like every year, 2021 brings distinctive marketing trends to the table. The COVID-19 pandemic and resulting economic challenges continue to drive the conversation in most industries. To get more for your marketing dollars, you’ll need […]

January 15, 2021 READMORE -

New Coronavirus Relief Bill and What We Know Now

As many of you know, the Senate passed a (roughly) $900 billion COVID-19 stimulus deal Monday, December 21, 2020 in the late evening. This includes another round of stimulus checks and benefits for jobless Americans. As we dive further in to the details of the bill, below are initial findings we want you to be […]

December 22, 2020 READMORE -

2021 Update for Colorado Employers

As many are aware, Colorado businesses will be subjected to numerous changes the beginning of 2021. This email below outlines changes you should be aware of. Minimum Wage in the state of Colorado will increase to $12.32 on January 1, 2021. The Healthy Families and Workplaces Act (SB 20-205): Starting July 14th, 2020 through December 31, […]

December 21, 2020 READMORE -

2020 Arizona Tax Credits – Easy Reference Guide (AZ Residents Only)

2020 Arizona Tax Credits – Easy Reference Guide (For Arizona State Residents only) Arizona individual taxpayers have the opportunity to redirect state income tax to a variety of Arizona charities through the use of Arizona tax credit contributions. Contributions to certain charities or public schools will not qualify for a federal charitable contribution deduction. Taxpayers […]

November 22, 2020 READMORE -

2020 Tax Planning Letter – BUSINESSES

2020 YEAR-END INCOME TAX PLANNING FOR BUSINESSES INTRODUCTION It’s that time of year when businesses normally start developing year-end planning strategies. However, there has never been a year quite like 2020. We at ATLAS think it is safe to say that year-end tax planning for 2020 is proving to be the trickiest in recent memory. […]

November 22, 2020 READMORE -

Tax Planning Letter – INDIVIDUALS

2020 YEAR-END INCOME TAX PLANNING FOR INDIVIDUALS INTRODUCTION With year-end approaching, this is the time of year we suggest possible year-end tax strategies for our clients. However, there has never been a year quite like 2020. We at ATLAS think it is safe to say that year-end tax planning for 2020 is proving to be […]

November 22, 2020 READMORE -

Paycheck Protection Program – Forgiveness Update

We are committed to keeping you up-to-date with news about the Paycheck Protection Program (PPP). On November 18, 2020, the Internal Revenue Service (IRS) issued a Revenue Ruling (2020-27), a Revenue Procedure (2020-51), and added two Frequently Asked Questions (FAQs) which address PPP issues. The Revenue Ruling (Rev. Rul.) and the Revenue Procedure (Rev. Proc.) […]

November 20, 2020 READMORE -

ATLAS Expands Into West Texas

We are excited to announce three new ATLAS locations have been added to our West Texas territory: Lubbock, Plainview, and Floydada. This is an exciting expansion for the ATLAS family of firms. These offices will operate under the name, CMMS CPAs & Advisors PLLC, which is an ATLAS Navigators LLC firm, and is the name […]

November 15, 2020 READMORE -

New ATLAS Location – Levelland, TX

We are excited to announce the addition of a new ATLAS location in Levelland, Texas. The addition of a second Texas office is an exciting development for the ATLAS family of firms. As with its predecessor in Amarillo, our new Levelland location will operate under the firm name, CMMS CPAs & Advisors PLLC, which is an […]

November 14, 2020 READMORE -

New ATLAS Location – Amarillo, TX

We are excited to announce the addition of a new ATLAS location in Amarillo, Texas. This is an exciting expansion for the ATLAS family of firms. Our new Texas office will operate under the firm name, CMMS CPAs & Advisors PLLC, which is an ATLAS Navigators LLC firm. Continue reading about this recent merger in […]

November 13, 2020 READMORE -

What Tax Records Can You Throw Away?

October 15 is the deadline for individual taxpayers who extended their 2019 tax returns. (The original April 15 filing deadline was extended this year to July 15 due to the COVID-19 pandemic.) If you’re finally done filing last year’s return, you might wonder: Which tax records can you toss once you’re done? Now is a […]

October 15, 2020 READMORE -

ATLAS Update: PPP Update – New Interim Final Regulation

As you are well aware, we have been monitoring the Small Business Administration (SBA) for updates concerning the Payroll Protection Program (PPP). Although Congress has not yet acted, yesterday the SBA announced, through its regulatory authority, a new Interim Final Regulation (IFR) making a de minimus exception from the FTE employee reduction for PPP loans less […]

October 9, 2020 READMORE -

A PPP Update: Pending Legislation

Understandably, everyone is on pins and needles dealing with 2020 events that seem to pour into our consciousness every waking hour. Concerning the Payroll Protection Program (PPP), rumors have been flying about potential legislative modifications. You hear them, we hear them. We want to provide a glimpse into what MIGHT happen, should legislation be passed […]

September 24, 2020 READMORE -

Forecasting Financial Results for a Start-Up Business

There’s a bright side to today’s unprecedented market conditions: Agile people may discover opportunities to start new business ventures. Start-ups need a comprehensive business plan, including detailed financial forecasts, to drum up capital from investors and lenders. Entrepreneurs may also use forecasts as yardsticks for evaluating and improving performance over time. However, forecasting can be challenging […]

August 15, 2020 READMORE -

Thoughtful Onboarding is More Important Than Ever

Although many businesses have had to reduce their workforces because of the COVID-19 pandemic, others are hiring or may start in the weeks or months ahead. A thoughtful onboarding program has become more important than ever in today’s anxious environment of safety concerns and compliance challenges. Crucial opportunity Onboarding refers to “[a formal] process of […]

August 6, 2020 READMORE -

6 Key IT Questions to Ask in the “New Normal”

The sudden shutdown of the economy in March because of the COVID-19 pandemic forced many businesses to rely more heavily on technology. Some companies fared better than others. Many businesses that had been taking an informal approach to IT strategy discovered their systems weren’t as robust and scalable as they’d hoped. Some may have lost […]

July 21, 2020 READMORE -

Does Your Business Have a Unique Selling Proposition?

Many business owners — particularly those who own smaller companies — spend so much time trying to eliminate weaknesses that they never fully capitalize on their strengths. One way to do so is to identify and explicate your unique selling proposition (USP). Give it some thought In a nutshell, a USP states why customers should […]

July 2, 2020 READMORE -

CFU & ATLAS QuickBooks Classes For You!

Some of our very own ATLAS QuickBooks Advisors have teamed up with the great people at Colorado Free University to offer you classes on how to use QuickBooks for your success! Classes will be taught by ATLAS Team members, Libby Smith, Talena Johnson and Kelli Marincin. More information, class options and registration can be found […]

June 30, 2020 READMORE -

ATLAS Q&A Video: The PPP and its Loan Forgiveness

This video answers several questions we have seen or received in regard to The Paycheck Protection Program and its Loan Forgiveness. This video is presented by ATLAS Managing Partner, Loni Woodley, and Westminster Partner, Fran Coet. For additional details or questions, please do not hesitate to contact us here.

June 19, 2020 READMORE -

ATLAS Video: The PPP and Its Loan Forgiveness

In this video, ATLAS Managing Partner, Loni Woodley, and Westminster Partner, Fran Coet, discuss the Paycheck Protection Program and its Loan Forgiveness. As always we will continue to update you on changes regarding this topic. Check back for updates! Links from video: Slide 3: SBA releases instructions to calculate PPP loan forgiveness Small […]

June 19, 2020 READMORE -

ATLAS Update: New EZ PPP Loan Forgiveness Application Form

On Wednesday, June 17, 2020, the SBA came out with the EZ PPP Loan Forgiveness Application Form to streamline the forgiveness process for most business owners. We have seen several tweaks to the Paycheck Protection Program throughout the past weeks including the Paycheck Protection Flexibility Act. This act made changes making PPP loan forgiveness more […]

June 19, 2020 READMORE -

ATLAS Update: Paycheck Protection Flexibility Act

The U.S. Senate passed the House version of Paycheck Protection Program (PPP) legislation June 3, 2020, tripling the time allotted for small businesses and other PPP loan recipients to spend the funds and still qualify for forgiveness of the loans. The Senate approval sends the House bill, called the Paycheck Protection Flexibility Act, to President Donald […]

June 4, 2020 READMORE -

ATLAS Video: Post-Pandemic Survivor Skills for Small-Medium Businesses

This video from our Managing Partner, Loni Woodley, and Partner in Westminster, CO, Fran Coet, discusses post-pandemic survival skills to help small to medium sized businesses recover. We will continuously update information regarding this topic with notes here. Check back for updates and, as always, send your questions to us via our contact us […]

June 2, 2020 READMORE -

How ATLAS Can Help Now: Is Your Paycheck Protected?

May is Disability Insurance Awareness Month. Here are some facts our ATLAS Risk Management Group (RMG) thought you may want to consider and may surprise you: QUICK FACTS Just over 1 in 4 of today’s 20 year-olds will become disabled before they reach retirement age. 70% of American employees live from paycheck to paycheck, without enough […]

May 20, 2020 READMORE -

How ATLAS Can Help Now: Ransomware and How to Protect Your Data

Ransomware is a profitable market for cybercriminals and can be difficult to stop. Prevention is the most important aspect of protecting your personal data. To deter cybercriminals and help protect yourself from a ransomware attack, keep in mind these 7 dos and don’ts from our ATLAS IT Services Team. 1. Do use security software. To help […]

May 7, 2020 READMORE -

How ATLAS Can Help Now: How the CARES Act Impacts your IRA and RMDs for 2020

The legislation in the Coronavirus Aid, Relief, and Economic Security (CARES) Act includes policy changes that impact Individual Retirement Accounts (IRA) owners and Required Minimum Distributions (RMDs) for the 2020 calendar year. Those of you who are retirement account owners can use relief offered through the CARES Act by suspending 2020 RMDs that are not […]

April 28, 2020 READMORE -

ATLAS Video: Paycheck Protection Program – Loan Forgiveness

Video recorded 4/23/2020 This video answers several questions we have received regarding Loan Forgiveness with a Paycheck Protection Program loan. If you feel your question was not answered or have additional questions, please do not hesitate to contact us here. As you may have heard, an additional Coronavirus Relief package providing more funding for SBA loans […]

April 25, 2020 READMORE -

Paycheck Protection Program – Loan Forgiveness

We wanted to provide you with additional information and clarification when it comes to the Paycheck Protection Program (PPP) Loan Forgiveness. If you have additional questions, please do not hesitate to reach out to your ATLAS office or contact us here. Things to Know About the Loan Forgiveness: Forgiveness is equal to the amount of qualifying […]

April 23, 2020 READMORE -

How ATLAS Can Help Now: Is Your Technology Protected?

Is Your Technology Protected? Today, many people are working remotely – whether that is due to COVID19 or just regular operations for your organization. Remote users use various devices to access and use critical data while not physically at the organization’s facility. Providing employees remote access is necessary today. But it comes with a big […]

April 11, 2020 READMORE -

Paycheck Protection Program Loans (FAQs)

The Small Business Administration (SBA), in consultation with the Department of the Treasury, intends to provide timely additional guidance to address borrower and lender questions concerning the implementation of the Paycheck Protection Program (PPP), established by section 1102 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act or the Act). We will continue […]

April 8, 2020 READMORE -

ATLAS Q&A Video: CARES Act Paycheck Protection Program – SBA Loans

Recorded 4/7/2020 This video answers additional questions and hopefully provides some clarity to the Paycheck Protection Program regarding SBA loans. As you know, this situation is fluid and guidance from the government agencies involved continues to come out. We will continue to post updates on this page and get you the newest information as soon […]

April 7, 2020 READMORE -

ATLAS Q&A Video: CARES Act and FFCRA for Businesses – SBA Loans

We hope this video answers your questions we received about the CARES Act, FFCRA and SBA loans for businesses. **Please note: When this was prepared, we were waiting on final specifics. Some of those specifics have been issued since the recording of this video. We will add updates continuously on this page. Check back for updates […]

April 3, 2020 READMORE -

ATLAS Q&A Video: CARES Act and FFCRA for Individuals and Families

Please enjoy the first of several videos we will be providing on your most frequently asked questions on the CARES Act, FFCRA and other legislation in response to COVID-19. We know this is a confusing and difficult time for people so we hoped to gather as much information as possible to answer your questions […]

April 2, 2020 READMORE -

Details from Lenders on PPP SBA Loans

Updated: 4/6/2020 Loan applications have opened through banks to provide SBA PPP loans. While each bank has a slightly different list of items they need to get the application process started, we are happy to help you with the process. Contact us here to be contacted by our SBA PPP loan assistance team. One Update […]

April 1, 2020 READMORE -

ATLAS Update: The CARES Act – What We Know

Information on the CARES Act – Passed by The Senate March 25, 2020. Passed by the House and signed by The President March 27, 2020. Updated 3/27/2020 As of March 27, 2020, the Senate and House have passed the $2 trillion “Phase Three” COVID-19 economic stabilization package, H.R. 748, the ‘Coronavirus Aid, Relief, and […]

March 26, 2020 READMORE -

IRS People First Initiative

The IRS has unveiled a People First Initiative to provide immediate relief to taxpayers. The IRS has initiated several steps to help those who are dealing with tax liabilities and other tax issues in these uncertain and difficult times. This is the first time in a long time we have seen the IRS go to this […]

March 26, 2020 READMORE -

Department of Labor: Families First Coronavirus Response Act (FFCRA)

Updated 3/26/2020 In response to the adjustments employees and employers are continuing to make because of COVID-19, the Department of Labor has put out information about Employee Rights under the new Families First Coronavirus Response Act (FFCRA). Below is a link to that information. https://www.dol.gov/sites/dolgov/files/WHD/posters/FFCRA_Poster_WH1422_Non-Federal.pdf This poster details requirements and qualifications around employers providing employees with […]

March 26, 2020 READMORE -

ATLAS Update: Federal Tax Deadline Extended from April 15 to July 15, 2020

Dear Clients, In recent news, the IRS and the President have issued statements confirming the extension of the federal tax filing deadline to July 15, 2020. The first communication came this morning in a tweet from the Secretary of the Treasury. Additional information can be found here: https://www.accountingtoday.com/news/trump-moves-tax-day-to-july-15-because-of-coronavirus You can also read the passed bill here: […]

March 20, 2020 READMORE -

ATLAS COVID-19 Update: A letter from our Managing Partner, Loni Woodley

Dear Clients and Friends, Amid the outbreak of COVID-19, we’re taking measures to maintain the highest possible level of client service while protecting our team members and you. We are continuing to monitor updates and news surrounding COVID-19 and have taken the following measures to mitigate risks and keep everyone safe. Please read the changes happening […]

March 18, 2020 READMORE -

ATLAS COVID-19 Update: SBA Loan/Disaster Assistance Information

We will continue to update information on SBA Disaster Assistance that comes out. Please scroll through this page to see past updates on this subject. Most recent news will be at the top! An Update as of 3/23/2020: Dear Clients, As you may have heard, lawmakers are working on a relief bill in response […]

March 17, 2020 READMORE -

Accounting for Indirect Job Costs the Right Way

Construction contractors, professional service firms, specialty manufacturers and other companies that work on large projects often struggle with job costing. Full cost allocations are essential to gauging whether you’re making money on each job. But some companies simply lump indirect job costs into overhead or fail to use meaningful cost drivers, thereby skewing their profit […]

February 28, 2020 READMORE -

4 Key Traits to Look for When Hiring a CFO

Finding the right person to head up your company’s finance and accounting department can be challenging in today’s tight labor market. While it may be tempting to simply promote an existing employee, external candidates may offer fresh ideas and skills that take your financial reporting to the next level. Here are four traits to put […]

February 17, 2020 READMORE -

3 Best Practices for Achieving Organic Sales Growth

Most business owners would probably agree that, when it comes to sales, there’s always room for improvement. To this end, every company should strive for organic sales growth — that is, increases from existing operations unrelated to a merger or acquisition. That’s not to say a merger or acquisition is necessarily a bad idea, but […]

February 5, 2020 READMORE -

5 Ways to Strengthen Your Business for the New Year

The end of one year and the beginning of the next is a great opportunity for reflection and planning. You have 12 months to look back on and another 12 ahead to look forward to. Here are five ways to strengthen your business for the new year by doing a little of both: 1. Compare […]

January 10, 2020 READMORE -

Tax Planning – So Why Should You Tax Plan?

If you were to look up “Tax Planning”, the definition would be: Tax planning is the analysis of a financial situation or plan from a tax perspective. The purpose of tax planning is to ensure tax efficiency. Through tax planning, all elements of the financial plan work together in the most tax-efficient manner possible. Tax […]

November 10, 2019 READMORE -

Employee Retention – How to Keep Great Employees

Why do people leave their jobs? The number one reason: they don’t like their leadership. Please don’t leave companies, they leave people. Why? Because a lot of leadership doesn’t know how to lead. Power and influence don’t work for everyone. If you want to test a person’s character, give them power. The first thing to […]

October 30, 2019 READMORE -

ATLAS CPAs & Advisors Announces New Partner, Kelli Berardi, CPA

Press Release Announcing Kelli Berardi, CPA as Partner can be read below! ATLAS CPAs & Advisors PLLC (ATLAS), a regional tax, accounting and consulting firm with locations across Arizona, Colorado, Iowa and Illinois, has recently promoted Kelli Berardi, CPA to Partner. Berardi has served from the Northwest Phoenix location of ATLAS for over 6 […]

September 30, 2019 READMORE -

The Secret of Learning

Would you like to know the secret of learning? First, we have to have an open mind. This is an attitude shift. The key is having a childlike attitude. What do we mean by that? Children are simple (and incredible) characters. They are curious therefore teachable. They do not have any false pretenses, so they […]

August 25, 2019 READMORE -

ATLAS CPAs & Advisors PLLC Announces New Partner, Brooke Greve, CPA

ATLAS Press Release ATLAS CPAs & Advisors PLLC (ATLAS), a regional tax, accounting and consulting firm with locations across Arizona, Colorado, Iowa and Illinois, has recently promoted Brooke Greve, CPA to Partner. Greve has served at the Englewood (Denver Tech Center- DTC) location of ATLAS for over two years as Manager. She has served clients […]

May 20, 2019 READMORE -

ATLAS Announces Promotion of Everlene Romero, CPA to Senior Manager

ATLAS Press Release: ATLAS CPAs & Advisors PLLC (ATLAS), a regional tax, accounting and consulting firm with locations across Arizona, Colorado, Iowa and Illinois, has recently promoted Everlene Romero, CPA to Senior Manager. Romero has served at the Northwest Phoenix location of ATLAS for over 11years as Manager. She has served clients from all locations […]

May 12, 2019 READMORE -

ATLAS CPAs & Advisors Merges New Firm in Phoenix, AZ

Canyon Financial Services, LLC Announces Merger with ATLAS CPAs & Advisors PLLC A local business valuation, litigation and consulting firm, previously known as Canyon Financial Services (CFS), has recently announced its merger with ATLAS CPAs & Advisors PLLC, an accounting, tax and consulting firm with locations across Colorado, Arizona, Iowa and Illinois. ATLAS CPAs & […]

March 15, 2019 READMORE -

ATLAS CPAs & Advisors PLLC Announces New Partner, Gautam Gupta

ATLAS CPAs & Advisors PLLC Announces New Partner, Gautam Gupta ATLAS CPAs & Advisors PLLC (ATLAS), a regional tax, accounting and consulting firm with locations across Arizona, Colorado, Iowa and Illinois, has recently promoted Gautam Gupta, CPA to Partner. Gupta has served at the Northwest Phoenix location of ATLAS for over 8 years as Manager. […]

February 18, 2019 READMORE -

Rental Properties – Are they eligible for 199A (20%) Deduction?

As Congress and the IRS continue to more clearly define the New Tax Act we will attempt to keep you informed. Recently they defined the rules around rental properties. For 2018 and beyond, rental property owners (Individuals, Partnerships, Trusts and S Corporations) can qualify for the 199A deduction if certain qualifications are met: • Must […]

February 11, 2019 READMORE -

For AZ clients and residents: New Info – Electronic filing, S-Corps and Vehicles

New information on S-Corps and Personal Vehicles Health Insurance premiums paid on behalf of a >2% shareholder-employee are deductible by the S-Corporation and reportable as wages on the shareholder-employees’ Form W-2, included in boxes 1, 14 and 16. It is also required by the IRS that we include a line on your W-2 for amounts […]

November 29, 2018 READMORE -

ATLAS Boss – Tax Cuts and Jobs Act: What We Know Now

November 27, 2018 READMORE -

Why Tax Planning is So Important Now

Why Tax Planning is So Important Now Tax Planning is more important than ever before. The IRS just enacted the largest changes in the past 30 years. While the federal income tax regulations are now more complicated than ever, the benefits of strategic tax planning are more valuable than ever before. What is Tax […]

November 19, 2018 READMORE -

Marketing

November 9, 2018 READMORE -

New Tax Law

November 9, 2018 READMORE -

Top Four Reasons to Join a 401k Multiple Employer Plan

https://youtu.be/tdWNbproZaY

November 9, 2018 READMORE -

10 Tips to Reduce Your Risk of a Data Breach

Cybersecurity is important and ever-changing. Major data breaches are a common topic in news today. It is estimated that $150 billion is lost annually by businesses of all sizes due to data and identity theft.(1) Only 1 in 4 organizations feel they are highly immune to cyberattacks.(2) The best way to prevent a cybersecurity attack is […]

October 24, 2018 READMORE -

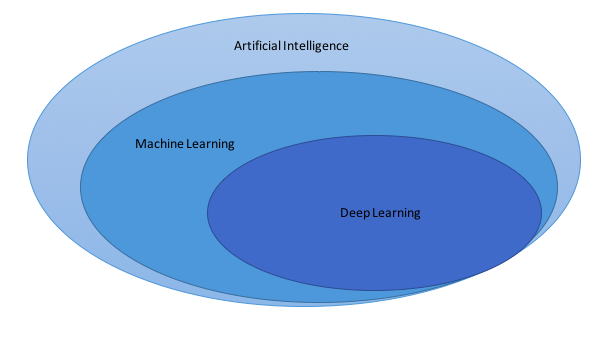

What is Artificial Intelligence?

And why are we hearing so much more about it now? Artificial Intelligence (AI) is BIG. In fact, it will soon be the biggest thing since the Internet itself. But what is it, exactly? The simplest explanation is that it’s our ever-improving ability to make digital technology – computers – approximate the functionality and capability […]

June 28, 2018 READMORE -

How to Create a Crisis Management & Response Plan

How to Create A Crisis Management & Response Plan Creating a crisis management response plan is something most organizations don’t want to think about. Numerous studies also confirm that only about half of all organizations have any kind of crisis plan in place. Make sure your company is prepared. If your company is one of […]

May 25, 2018 READMORE -

The Importance of Employee Recognition for Business Performance

The Importance of Employee Recognition for Business Performance Did you know that organizations with formal recognition programs have 31% less voluntary turnover than organizations that don’t have any program at all? And they’re 12X more likely to have strong business outcomes. Do you know what motivates employees, the benefits (and costs) of employee recognition, and […]

May 15, 2018 READMORE -

Impact of Tax Reform on HR

What Should Employers and HR Professionals Know About Tax Reform? On December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act—the most substantial reform of the U.S. tax code in over 30 years. This new law, which went into effect on January 1, carries significant changes to both individual and business […]

May 9, 2018 READMORE -

Top HR Trends 2018

The world of Human Resources is constantly evolving, and each new year ushers in new laws and trends that impact the workplace. For employers and HR professionals, it is crucial to keep abreast of these changes and understand how they affect an organization’s ability to build and manage a successful workforce. Several trends defined HR […]

May 9, 2018 READMORE -

Changing Performance Reviews? Focus on these Core Concepts.

Performance reviews are dead, or so we have been told. The data shows a shrinking support for the traditional method: only 15% of companies have not adjusted their annual performance management process and do not plan to. But the data from our Performance Management, Culture, and Business Results study shed a different light on the […]

May 9, 2018 READMORE -

Tax Reform: More Jobs | Fairer taxes | Bigger Paychecks

President Trump has laid out four principles for tax reform: First, make the tax code simple, fair and easy to understand. Second, give American workers a pay raise by allowing them to keep more of their hard-earned paychecks. Third, make America the jobs magnet of the world by leveling the playing field for American businesses […]

October 18, 2017 READMORE -

Trump Proposes the Most Sweeping Tax Overhaul in Decades

President Trump on Wednesday began an ambitious push to slash taxes and salvage what remains of his embattled legislative agenda in Congress this year, proposing a politically challenging array of tax cuts for individuals and businesses that would constitute the most sweeping changes to the federal tax code in decades. Read the full NY Times […]

October 18, 2017 READMORE -

Equifax Data Breach – Please Read and Share

By now you have probably heard about one of the largest data breaches in US history – the Equifax data breach. If you have a credit report, there is a good chance that you are one of the 143 million American consumers whose sensitive personal information was exposed. As a client of ATLAS CPAs & […]

October 18, 2017 READMORE -

Pit Stop Reality Check: Powerful Decision-Making Tools Beyond Your Gut

August 7, 2017 READMORE -

Guides Point the Way: Trusted Advisors Alert You to Potholes and Possibilities

August 7, 2017 READMORE -

In Case the Wheels Come Off: Expect the Best, Prepare for the Worst

August 7, 2017 READMORE -

Begin With the End in Mind: Grow Your Business Into the Future

August 7, 2017 READMORE -

Colorado Regulations on Electronic Documents and Record Retention

Electronic Documents and Record Retention A frequent question that we receive from clients with Colorado businesses is what are the federal and Colorado rules related to record retention and electronic document storage and retrieval? Federal law states that all taxpayers subject to income tax must keep books and records that are sufficient to establish […]

October 22, 2015 READMORE -

Year End Tax Planning with Fixed Assets

Year End Tax Planning with Fixed Assets As 2015 comes ever closer to an end, it is time to consider your tax planning options for the remainder of the year. One aspect of tax planning for a business is how to account for fixed asset purchases in the most tax efficient manner. There are several […]

September 24, 2015 READMORE -

Checkups for Small Businesses

Like individuals, businesses might want to tackle these finance-related projects early in 2015: 1. Renegotiate your lease. You may be overpaying rent if you signed your lease five (or more) years ago. If your current landlord isn’t willing to renegotiate the lease terms, consider switching to another location with lower rent, more usable space or […]

May 30, 2015 READMORE -

3 Financial Metrics for Business Success

There is a large amount of data available to help you more effectively manage and grow your business. But, how do you know which numbers to crunch, and what the data is telling you? While it’s true that the importance of certain financial metrics will vary depending on your industry, there are three important financial […]

May 25, 2015 READMORE